36+ minnesota mortgage registration tax

Hennepin County adds an additional 0001 for an. Web Minnesota counties collect Mortgage Registry Tax when a mortgage securing a debt amount is presented for recording.

Mortgage Deed Tax Calculator

Web No tax under section 287035 shall be paid on the indeterminate amount that may be advanced by the mortgagee in protection of the mortgaged premises or the mortgage.

. Fees Due with Each. Web Commercial Lending and Loan Documentation When filing a mortgage determining the amount of mortgage registration tax MRT is relatively simple. Minnesota Department of Revenue Deed Tax Information and Mortgage Registration Tax.

Web For additional assistance with determining registration tax contact your local deputy registrar or email DVS at DVSmotorvehiclesstatemnus. Generally if you are a Minnesota resident own the home and occupy the home as your primary. Web Mortgage Registration Tax Minnesota Statute 287035 provides for mortgage registration tax to be paid on mortgages to be recorded.

Web 1 a decree of marriage dissolution or an instrument made pursuant to it. Web The tax is collected and paid to the Minnesota county where the mortgage document is being recorded. 3 a mortgage or other.

The rate is 00023 of the mortgage amount. Web Mortgage registry tax MRT MRT is paid when recording a mortgage. Web Mortgage Registration Tax is due on recording of mortgages which are secured by real property located in Minnesota.

The amount of the tax is determined by multiplying 0023. The rate is 00023 of the debt secured Example. 105250 X 23 24208.

Web The mortgage registry tax rate is 0023 of the amount of the debt being secured 0024 for Hennepin and Ramsey counties. Web In other words Homestead Taxes are lower than Non-homestead Taxes. Web Minnesota Statutes Chapter 287Mortgage Registry Tax.

Web Mortgage and Deed Taxes in Minnesota Page 4 Tax Overview Summary Table The following table highlights the current basic structure of the MRT and deed tax. 20 for each certificate. Tax Information Forms and Instructions Law Changes Resources Contact Info Email Contact form Phone.

Except in the counties. Web Minnesota counties collect Mortgage Registry Tax when a mortgage securing a debt amount is presented for recording. 2 a mortgage given to correct a misdescription of the mortgaged property.

Web 5 Minnesota Conservation Fund fee collected on each instrument where state deed tax or mortgage registration tax has been paid. The rate is 00023 of the total. Form MRT1 may be used to document your claim for.

Web Minnesota Statute 287035 provides for mortgage registry tax to be paid on mortgages to be recorded. Web Todays mortgage rates in Minnesota are 7047 for a 30-year fixed 6177 for a 15-year fixed and 7050 for a 5-year adjustable-rate mortgage ARM. The state Mortgage Tax rate is 00023 of the debt that is.

1 Mortgage Amendment s is a mortgage amendment.

Pdf Evaluation Of Changes To Physical Activity Amongst People Who Attend The Walking The Way To Health Initiative Whi Prospective Survey

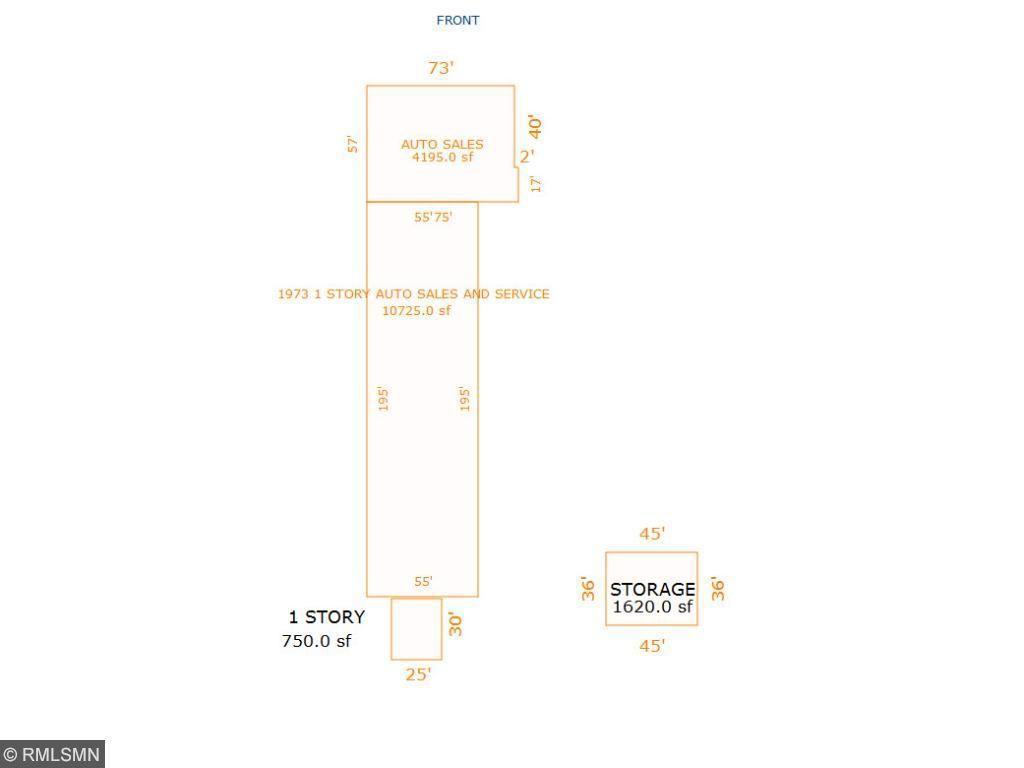

M Fsvkgh3egi7m

Yerli Otomobilde Yeni Gelisme Izin Yolu Gurbetciler

White Mountain Highway Milton Nh 03851 Mls 4925353 Trulia

Yerli Otomobilde Yeni Gelisme Izin Yolu Gurbetciler

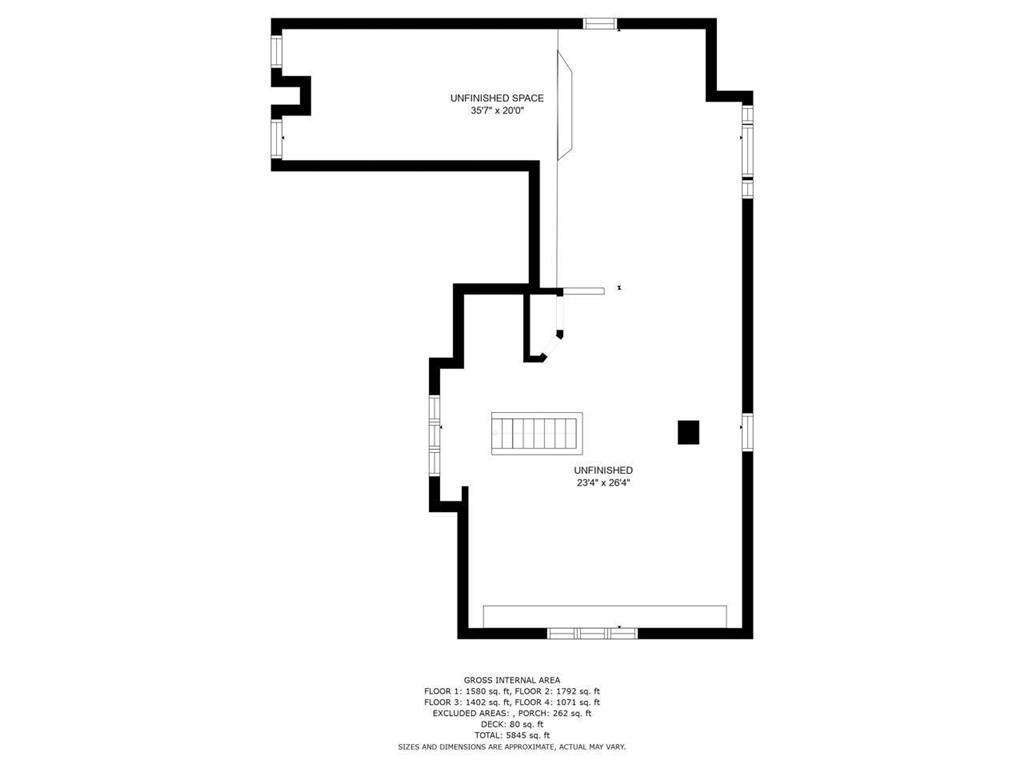

2928 Eastview Ct Anoka Mn 55303 Realtor Com

Brown County Property Taxation

Minnesota Financial Services Businesses For Sale Bizbuysell

91 Forest St 302 Westbrook Me 04092 Mls 1550873 Coldwell Banker

851 River Mews Court Unit 104 Minneapolis Mn 55414 Mls Id 6327457 Counselor Realty

1920s Wood Mens Head Face Sock Darner 6 1 4 Inches Nice Shape Some Wear Ebay

2098 Carroll Avenue Saint Paul Mn 55104 Mls 6271946 Edina Realty

9769 Wedgewood Circle Woodbury Mn 55125 Mls Id 6336077 Counselor Realty

2005 Index To Mn Business Periodicals

Banking And Loan Businesses For Sale Bizbuysell

Yerli Otomobilde Yeni Gelisme Izin Yolu Gurbetciler

Free 36 Bill Of Sale Forms In Ms Word